Home >> Blog >> Bad Faith Insurance Claims

Bad Faith Insurance Claims: Why You Need an Attorney

When you are a policyholder with an insurance company, you pay your premiums with the expectation you have protection. You have insurance to pay for losses in a fire, car accident, and the like.

While an insurance company should treat you fairly and honor all valid policy claims, they will sometimes fail to do so during the investigation process and not pay the policyholders. When this occurs, this is what you call a bad faith insurance claim.

If this happens to you, an attorney is an invaluable resource in your fight to validate and uphold your claim. Read on to learn some ways an attorney can make a difference with these cases.

Offer Professional Experience and Insight

Because the insurance industry involves many complex laws and legalities, you will need the professional insight of an attorney to help you pursue a claim that will get you the compensation you deserve.

Attorneys who have years of experience in this field of law will be aware of the reasons why an insurance company wants to deny claims, even if they are valid. They also know how insurance companies work to deal with disputes when policyholders appeal a denial. Your attorney will know a bad faith claim immediately.

When your attorney looks at your claim and sees efforts that constitute bad faith, he or she will know exactly how to approach your case to help you win. Indicators of bad faith include delays that seem unreasonable, the lack of proper investigations, the lack of a reason for your claim denial, or misleading information about your coverage.

Provide You with an Even Field

Insurance companies equip themselves with the best legal representation. They also have money at their disposal to assist with their legal disputes with policyholders. Because of this, insurance companies can leverage their significant resources to ensure they can capitalize on the fact you do not have the legal expertise to win a legal battle yourself.

With an attorney's assistance, you are now legally on an even playing field. When you have an attorney, you will not have limitations as you deal with your insurance company's refusal to support your claim.

Fight for Your Claim in Court

Solving a dispute with an insurance company on your own is very difficult. The insurance company will know if you choose not to have an attorney work for you on your claim, which means they know you will not have the power or knowledge to litigate your claim.

When you work with an attorney with a solid record of insurance litigation, you will have more flexibility and expertise to fight the insurer if your case ends up in court.

Protect Your Bottom Line

Companies who handle claims in bad faith demonstrate they have more concern for their own bottom line instead of yours.

This is when you need to involve your attorney, as you will not get anywhere by yourself. The insurance companies hope you simply give up and accept their decision. Work with legal representation to make sure your interests are covered. This will help protect your rights and interests.

While an insurance company should serve as a financial form of protection for you, they will not always work in your favor.

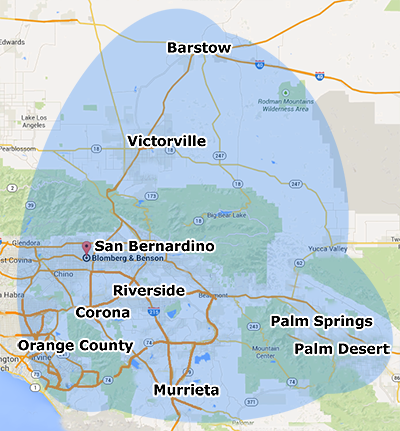

If you have a claim in bad faith, please contact us at Blomberg Benson & Garrett, Inc. We have provided the residents of the Inland Empire, including San Bernardino, Riverside, and Orange Counties, with outstanding legal services for more than 25 years. Please call us at 909-453-4370 to speak to one of our helpful staff members or to set up an appointment.