Home >> Blog >> Talking To Insurers After An Accident What You Need To Know

Talking to Insurers After an Accident: What You Need to Know

When you get into a car accident in California, there are some important things you should do right away. Call the police to report the accident, get medical help, and report the accident to the insurance company. If the accident was due to the other driver's actions, his or her insurer may try to contact you before you have a chance to contact your insurance company.

The question many people have is whether or not they should speak to another insurance company or adjuster before speaking to an attorney. The following information will help you know what to do when an insurer contacts you after a car accident.

Are You Obligated to Speak to Your Own Insurers?

You need to report your accident to your own insurance company and follow any instructions provided to you. They will have questions about the accident and your losses. Based on your own policy, you could receive additional compensation from your own insurance in addition to the settlement from the insurance company of the other driver.

However, you do not have an obligation to speak to the other party's insurance company at any time.

In most cases, you should have your attorney speak to your insurer for you and deal with all correspondence during the claim. If you do speak to your insurer directly, be sure to only stick to the basic facts of the case.

This includes the fact you were in a car accident, the fact that the accident resulted in property damage and injuries, whether or not you and the other driver exchanged your insurance information, whether or not the police were called, and if the police filed a report.

If you are asked to describe your injuries, let your medical records provide the details. You can simply state you injured your back and provide the medical report explaining exactly what you injured. The same goes with your property damage. You can state your car has damage on the right side, then provide the report from the body shop to confirm the details.

Why Should You Avoid Speaking to the Other Driver's Insurer?

You should not speak to the other driver's insurance provider because your words can be used as evidence against your claim. If you provide information that appears contradictory, the other insurer could use any contradictions to reduce their own liability. Your written or verbal statements to them can ultimately cost you a lot of money in compensatory damages.

Keep in mind your words to the at-fault party's insurance company do not necessarily have to be an official statement. If the adjuster for that company contacts you about your claim, any small details can hurt you.

For example, if you speak to the insurance company and casually mention how you work so much and do not get much sleep, they could claim you were the cause of the accident due to your own drowsiness. If you mention that you have been busy with your family on vacation, this can appear as though you are not as injured as you claim.

If you are not completely clear of fault in the case, you will not receive a full settlement, or you could not get a settlement at all. Even worse, you could be made to pay for the other person's losses. Ultimately, your best bet is to refer any requests for information from outside insurance companies to your attorney.

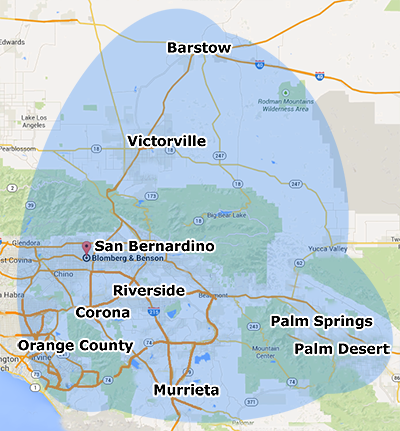

A car accident is frustrating and confusing at times, so you need a personal injury attorney on your side to help you get through the process. If you have any questions about insurance settlements or need help with your claim, please contact us at Blomberg, Benson & Garrett, Inc. We look forward to helping you with your case.